|

[VIEWED 6754

TIMES]

|

SAVE! for ease of future access.

|

|

|

|

Hoowdy

Please log in to subscribe to Hoowdy's postings.

Posted on 03-05-09 10:54

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Guys I have been working and living in one state and now I had moved to next state but I haven't done any job here here. So how should I file my Tax. Should I keep the first state where I was working before as a Resident State or should I have to file the first state as the Non-Resident and the new state as a Resident state

|

| |

|

|

|

|

Mr. OCDC

Please log in to subscribe to Mr. OCDC's postings.

Posted on 03-06-09 9:07

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

It depends upon when you move to the new state, state of residence is normally determined by how many days you were in that particular state. You can find this info in the tax form (instruction) of those states.

|

| |

|

|

syanjali

Please log in to subscribe to syanjali's postings.

Posted on 03-06-09 11:05

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Pretty state forward. In 2008 which state you were residing and making living ? Efile the federal and state tax using old mailing address even you did not live there even you have moved to other state in 2008. Best option is this.Use the current address as your permanent address, while filing state tax you have to show the income earned from previous and current state. Obviously, there is 0 income form your current state.No tax liability to your current state. Cheap and good as turbo tax go to Taxact.com. Try this and let us know how it Works. I can not think of any thing differently and do differently to my clients.

|

| |

|

|

Hoowdy

Please log in to subscribe to Hoowdy's postings.

Posted on 03-06-09 12:50

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Which state should I keep as the Resident State for efiling then? New one or the old one?

|

| |

|

|

Mr. OCDC

Please log in to subscribe to Mr. OCDC's postings.

Posted on 03-06-09 2:53

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Syanjali, The answer is not so straight forward as you define it. Even if you don't have any earning from the state or residency, you may end up paying tax in the state of residence not only in the state where you earned your income. So, it is wise to find out the state of residence first as (either new or old), which ultimately depends upon the no of days anyone was in particular state. And one more thing, if Hopwdy is in F1 (which I believe is true) he/she can't just use turbo tax or taxintruit for filing the federal as well as state tax return, it will take him to 1040 while he/she has to file 1040NR EZ. Hoowdy, I suggest you to go to both states income tax form and instructions and find out which state you belong the resident of. Good Luck

|

| |

|

|

Hoowdy

Please log in to subscribe to Hoowdy's postings.

Posted on 03-06-09 3:42

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I have not got the concrete answer yet. I am still confused.

|

| |

|

|

Mr. OCDC

Please log in to subscribe to Mr. OCDC's postings.

Posted on 03-06-09 4:09

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

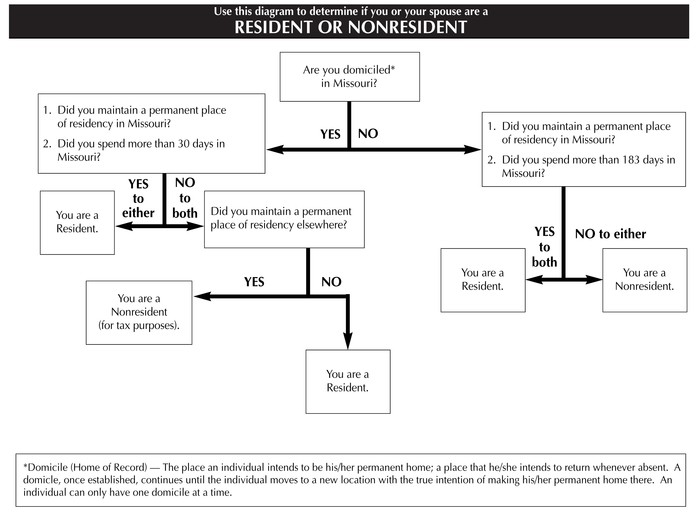

Mr. With the limited info, you are binding yourself for the correct info, however here is an example from Missouri, as I am a resident of Missouri. Try to find the same thing of the state where you are now.

|

| |